If What You Believe About Money Turns Out Not to Be True, When Would You Want to Know?

If what you believe about money isn’t true, when would you want to know? I first heard that question from Don Blanton, the founder of PEM life. Most of us would want to know right away if a belief we held was not, in fact, true. Many of us have been taught a thing or two about money that may not be true!

Mr. Blanton has worked to educate more than 20,000 financial advisors in his nearly 30 year career as president and founder of MoneyTrax Inc., and still maintains a successful personal practice as a financial advisor today. The core concepts, tools, and principles which he has developed to teach and train financial services professionals are now being made available through PEM LIFE curricula in an effort to extend financial literacy. Many families spend quite a bit of time and money on their students’ education yet many students graduate with little to no understanding of how to manage the money they will earn.

It is amazing that society puts so much emphasis on reading, writing and arithmetic, but excludes a need for practical lessons on personal finance. This class, available as a three hour dual enrollment class with Bryan College, or as a stand alone class without college credit, is now available to homeschooling families. This class is life-changing.

In sharing my personal experience with you, you may be surprised at the lessons I learned through this course. It is certainly different than the advice I had received from several Christian money management programs.

In sharing my personal experience with you, you may be surprised at the lessons I learned through this course. It is certainly different than the advice I had received from several Christian money management programs.

So, what is it that we have we been taught to believe that may not be true? Most of us have been led to believe that taking out loans should be avoided and that we should pay cash for everything when possible. We have been taught that we should pay off our loans, including mortgages, as soon as possible. We have been taught that having and using credit cards should be avoided. That’s the advice we have heard for many years. My husband and I were introduced to Don Blanton and the PEM class via my son (who was taking the class at Bryan College) right before we were to close on one house and purchase another. My son encouraged me to read the chapter on mortgages and my mind was blown. Mr. Blanton suggests that it might be preferable to take out a 30 year mortgage with a lower down payment rather than using cash on hand for the purchase. What? Don’t invest all the money from one home to another? Don’t go for the lowest loan amount possible? Don’t try and pay off the mortgage sooner rather than later? After reading the chapter I was almost convinced, but not quite — so I called Mr. Blanton and, after asking me a few questions about our situation, he convinced us that it would be wiser to have a higher mortgage amount at a low interest rate so that we would have access to cash for investment, emergencies, ministries, etc. Of course this decision was based on our ability to handle the mortgage payments. That was a year ago. We heeded his advice and have no regrets. We are currently refinancing at a lower interest rate and our monthly payments will be reduced by over $100 each month. We will leave the table with more cash. Do not interpret this as a condemnation on those who choose not to take out loans. Everyone needs to decide what is best in light of their finances and the options available.

We have been led to believe that if we take out a loan, then we are in debt. That is not necessarily true. Debt, as defined by Don Blanton, is when you have an obligation to pay with money that is yet to be earned. That is debt. Taking out a loan does not put you in debt unless you borrow more than you have. You may finance a new car at a low interest rate even though you have enough cash to be able to buy it outright. In that case you have a loan, but you are not in debt. Make sense? You are not having to make payments with future earnings.

Debt is an obligation to pay with money that is yet to be earned. It may take a little time to wrap your head around that. It did for me. When talking to Mr. Blanton about my hesitation to finance any purchase, he pointed out that we finance many expenses, not just those that require a loan. We pay monthly for our electric, wifi, gas, phone, and similar products and services. Those expenses are financed. We do not ask to pay up front in order to avoid a monthly payment, do we? Another lesson your student will learn in this class is that there are always additional costs associated with material possessions. A house is never truly ‘paid off’ because you will always have upkeep, insurance bills, and taxes to pay. Even when a car is purchased for cash or paid off, there are always additional transportation costs including upkeep, repairs, insurance and more.

Let’s talk about credit cards. Some money management programs suggest one should never get a credit card and that cash only should be used. Currently, that is turning out to be a problem since the pandemic has created situations where cash is not accepted for certain purchases. Credit cards are not, in and of themselves, an evil thing. Credit cards are a tool that many use for convenience, in order to earn points or get cash back, have purchases insured, or to simplify bookkeeping. When credit cards are procured without annual fees and paid off monthly, they offer many advantages to the card holder. Wisely using credit cards builds credit scores and having a credit card enables the card holder to be able to rent cars. One of my daughters uses a particular credit card to earn a free vacation annually. Another daughter was glad her husband used a credit card to rent a car when in Ireland because, when they had a flat tire, the repair was covered by the card. Even though credit cards can be beneficial to those who use them wisely, not everyone should have a credit card. Many people, especially teens, do not handle credit cards wisely and they end up owing more than they can afford (putting them in debt), and the late fees and interest charged for non-payment rack up. Is there a danger in having credit cards? Yes! Just like there is danger in driving a car. One does not get behind the wheel of a car (hopefully) until licensed, insured and prepared to drive. Credit cards in the hands of an irresponsible person is a recipe for disaster.

Let’s talk about credit cards. Some money management programs suggest one should never get a credit card and that cash only should be used. Currently, that is turning out to be a problem since the pandemic has created situations where cash is not accepted for certain purchases. Credit cards are not, in and of themselves, an evil thing. Credit cards are a tool that many use for convenience, in order to earn points or get cash back, have purchases insured, or to simplify bookkeeping. When credit cards are procured without annual fees and paid off monthly, they offer many advantages to the card holder. Wisely using credit cards builds credit scores and having a credit card enables the card holder to be able to rent cars. One of my daughters uses a particular credit card to earn a free vacation annually. Another daughter was glad her husband used a credit card to rent a car when in Ireland because, when they had a flat tire, the repair was covered by the card. Even though credit cards can be beneficial to those who use them wisely, not everyone should have a credit card. Many people, especially teens, do not handle credit cards wisely and they end up owing more than they can afford (putting them in debt), and the late fees and interest charged for non-payment rack up. Is there a danger in having credit cards? Yes! Just like there is danger in driving a car. One does not get behind the wheel of a car (hopefully) until licensed, insured and prepared to drive. Credit cards in the hands of an irresponsible person is a recipe for disaster.

Enrolling your students in this introduction to personal finance is a great first step in making sure they are ready for independent living. If your student takes the class as a dual enrollment class then they will be in an online class with other students. If you purchase the homeschool version, great care has been taken to provide everything you need to easily and successfully deliver the course material. From interactive lessons and resources which will challenge students, to the tutorials and coaching designed to assist instructors, all of the hard work has been done for you. The course practically teaches itself, and you’ll surely find that your students won’t be the only ones learning!

Enrolling your students in this introduction to personal finance is a great first step in making sure they are ready for independent living. If your student takes the class as a dual enrollment class then they will be in an online class with other students. If you purchase the homeschool version, great care has been taken to provide everything you need to easily and successfully deliver the course material. From interactive lessons and resources which will challenge students, to the tutorials and coaching designed to assist instructors, all of the hard work has been done for you. The course practically teaches itself, and you’ll surely find that your students won’t be the only ones learning!

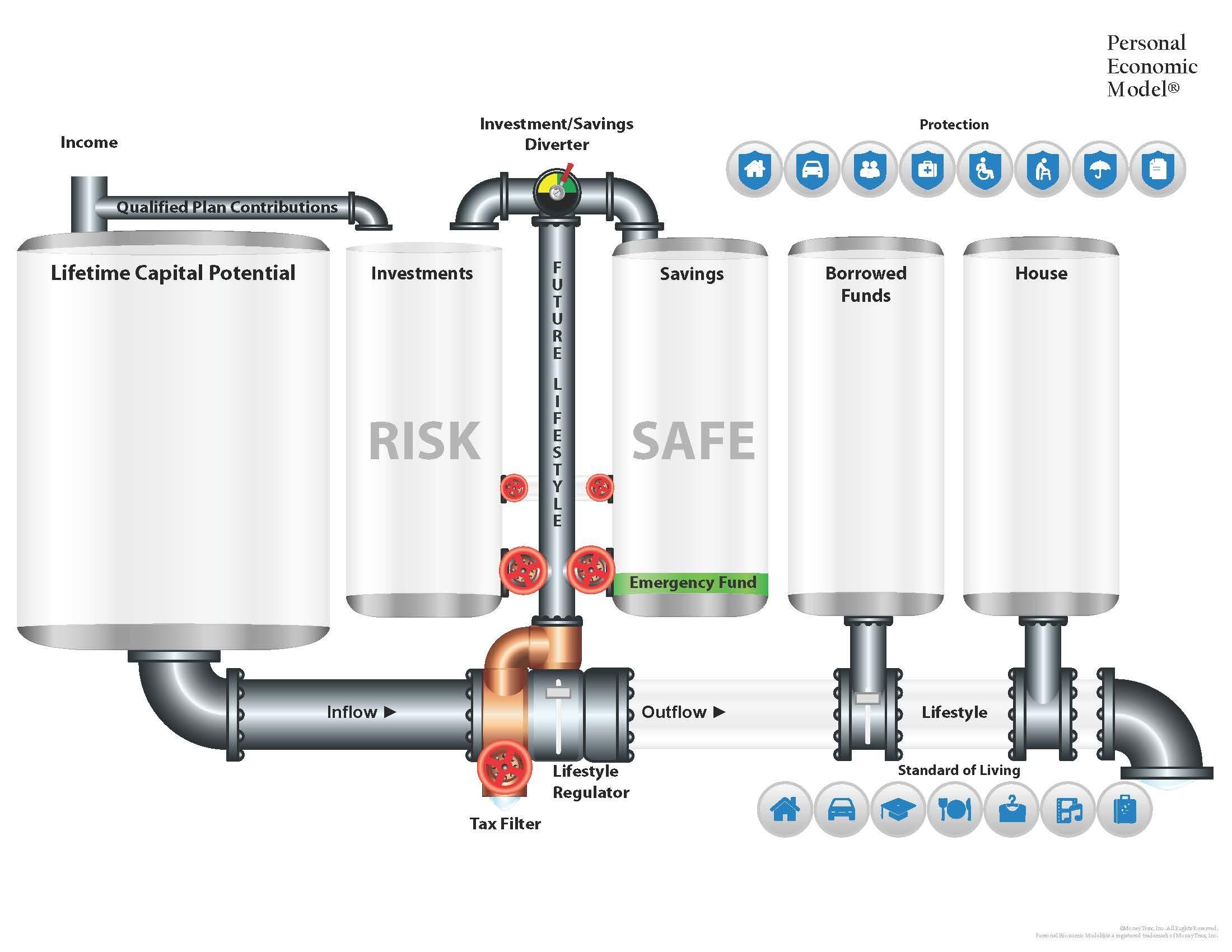

One of the best features of this course is the interactive visual model that Mr. Blanton has created for this course which allows the student to observe what actually happens to their money. This visual is called the Personal Economic Model (PEM). It shows the students exactly what happens to their money, depending on the choices they make. There are investments and savings that may defer taxes, but all money is taxed at some point. (Another belief dispelled is that there is no such thing as tax free earnings.) The visual model includes several tanks that represent money earned, money spent, money invested, and money saved. When students fully understand the financial lessons taught in this class they will be well prepared for life after high school. There is both a biblical and a secular version available. The price is amazing considering the students will have access to many tools and calculators that cost financial advisors a lot more. There are 15 core units, 64 individual lessons, 30 financial calculators, and hours of video instruction.

Students who have completed the 10th grade with a 3.0 GPA can take this class online with Bryan College, for college credit. If you live outside of Tennessee, a $200 scholarship is available, making the three hour class only $300. For Tennessee students, the DE grant will pay for the class if it’s one of the first two classes taken by the student. After the DE grant is used, a $200 scholarship will be offered to Tennessee students as well. The cost of materials is only $75. If you would like to have your student apply to Bryan College as a DE student, use the code bryanhss to waive the application fee.

Students who have completed the 10th grade with a 3.0 GPA can take this class online with Bryan College, for college credit. If you live outside of Tennessee, a $200 scholarship is available, making the three hour class only $300. For Tennessee students, the DE grant will pay for the class if it’s one of the first two classes taken by the student. After the DE grant is used, a $200 scholarship will be offered to Tennessee students as well. The cost of materials is only $75. If you would like to have your student apply to Bryan College as a DE student, use the code bryanhss to waive the application fee.

Students who want to take the class without college credit, or who do not yet qualify for dual enrollment, may take the class at home with a substantial savings. The course is priced at $199 and that includes the materials fee, but if you use this introductory offer code, Intro50, you can save $50 making this course only $149. Parents will appreciate how little work they will have to do with this course.

Take a look at the PEM website. There are a couple of videos worth watching. If you have any questions, let me know and I can put you in touch with Don Blanton, the founder of PEM Life. If what we believe about money isn’t true, the sooner we find out, the better.

go for it! The freedom and flexibility of homeschooling allows you to plan your students’ experiences around their

go for it! The freedom and flexibility of homeschooling allows you to plan your students’ experiences around their  directions you pursue. They do not have to understand or agree with your decisions, but your students should be required to respond respectfully to you (and to others).

directions you pursue. They do not have to understand or agree with your decisions, but your students should be required to respond respectfully to you (and to others).

the area in which you live. Some states require that you sign up with the local superintendent of education while others require you to join an umbrella or covering school. If you live outside of the US, there are also

the area in which you live. Some states require that you sign up with the local superintendent of education while others require you to join an umbrella or covering school. If you live outside of the US, there are also  Most libraries, as well as associations such as 4-H, offer programs that are either free, or very affordable. Oftentimes, local homeschool organizations have organized sports teams, theater groups, bands, speech and debate clubs, and more. Joining local Facebook groups is another way to connect with homeschooling families in your area. In addition to local groups, there are a few rather large Facebook groups with members from all over that you may consider joining, depending on which approach to homeschooling you choose. Two of the larger Facebook groups are

Most libraries, as well as associations such as 4-H, offer programs that are either free, or very affordable. Oftentimes, local homeschool organizations have organized sports teams, theater groups, bands, speech and debate clubs, and more. Joining local Facebook groups is another way to connect with homeschooling families in your area. In addition to local groups, there are a few rather large Facebook groups with members from all over that you may consider joining, depending on which approach to homeschooling you choose. Two of the larger Facebook groups are  be checked out from your local library. Cythnia Tobias is an expert. Attending one of her workshops years ago helped me understand my children and how they learn. It also helped me understand how I learn! Check out her

be checked out from your local library. Cythnia Tobias is an expert. Attending one of her workshops years ago helped me understand my children and how they learn. It also helped me understand how I learn! Check out her  materials needed for the approach you have chosen, and set goals. Will you homeschool for 9 months out of the year, or will you homeschool year around? Will you dedicate a certain part of each day to study or will the daily schedule be flexible? Join the groups you find helpful and register your students for any opportunities you’ve discovered that will be beneficial for your family.

materials needed for the approach you have chosen, and set goals. Will you homeschool for 9 months out of the year, or will you homeschool year around? Will you dedicate a certain part of each day to study or will the daily schedule be flexible? Join the groups you find helpful and register your students for any opportunities you’ve discovered that will be beneficial for your family. adjusting an attitude or switching approaches and/or curriculum.

adjusting an attitude or switching approaches and/or curriculum.

As I travel to college fairs and conferences, sharing Bryan College with homeschooled students, one of the often requested majors I hear students ask for is engineering. Two years ago when Bryan College announced the addition of an engineering school, I was thrilled. When our department was introduced to Dr. Marshall, the new Chair of the engineering school, I became even more excited about this program. Why? Because Dr. Marshall, being aware that engineers are able to get into places all over the world, even places that are often closed to Christians, has a heart for “missional engineering” (a term he may have coined). His vision for missional engineering is quite contagious.

As I travel to college fairs and conferences, sharing Bryan College with homeschooled students, one of the often requested majors I hear students ask for is engineering. Two years ago when Bryan College announced the addition of an engineering school, I was thrilled. When our department was introduced to Dr. Marshall, the new Chair of the engineering school, I became even more excited about this program. Why? Because Dr. Marshall, being aware that engineers are able to get into places all over the world, even places that are often closed to Christians, has a heart for “missional engineering” (a term he may have coined). His vision for missional engineering is quite contagious. computer science and bio-medical concentrations. Tailoring those concentrations for individual students, Bryan will actually offer course work credit for internship experiences so the students can work with engineering professions in the field in an area that dovetails with their concentration.

computer science and bio-medical concentrations. Tailoring those concentrations for individual students, Bryan will actually offer course work credit for internship experiences so the students can work with engineering professions in the field in an area that dovetails with their concentration. Students who enjoy using their knowledge of math and science to solve problems are often successful as engineers. Students involved in robotics, STEM, Lego or Minecraft clubs are also great candidates for an engineering program. For high school students planning to major in engineering, having a strong math and science foundation is recommended. Math up to pre-cal is expected, and going beyond is suggested. In addition, having strong speaking, listening, and critical thinking skills is an advantage.

Students who enjoy using their knowledge of math and science to solve problems are often successful as engineers. Students involved in robotics, STEM, Lego or Minecraft clubs are also great candidates for an engineering program. For high school students planning to major in engineering, having a strong math and science foundation is recommended. Math up to pre-cal is expected, and going beyond is suggested. In addition, having strong speaking, listening, and critical thinking skills is an advantage. I love that this is a starting program. Being a part of the first class and getting to help shape the program for the years to come is very exciting and encouraging to me. Then there’s the faculty. The faculty at Bryan College in general, and specifically the engineering program faculty, are so genuinely invested in our education, character as a whole, spiritual life and future that anyone who is a part of it cannot help but feel supported and encouraged. Being in engineering school is intimidating. It is such a demanding field, but knowing I have godly leaders surrounding me that will set me up for my future in the best way they know how, again, brings that peace that only can come from God.

I love that this is a starting program. Being a part of the first class and getting to help shape the program for the years to come is very exciting and encouraging to me. Then there’s the faculty. The faculty at Bryan College in general, and specifically the engineering program faculty, are so genuinely invested in our education, character as a whole, spiritual life and future that anyone who is a part of it cannot help but feel supported and encouraged. Being in engineering school is intimidating. It is such a demanding field, but knowing I have godly leaders surrounding me that will set me up for my future in the best way they know how, again, brings that peace that only can come from God. Whether it was in anyone’s plans or not, every family in the United States that has school age children has now experienced a taste of homeschooling. However, to be fair, those of you who were forced into this situation were not able to experience what it is like to be a homeschooling family that has time to plan ahead, order the materials that best suits your students, organize field trips, or take part in the co-ops and enrichment programs that are offered to homeschooling students. Most of you experienced distance learning in a stressful environment. In many situations both mom and dad have been working from home and in between the Covid19 restrictions and sharing computers and WIFI (while arbitrating phone, t-v, and video game usage), the experience has been less than ideal. On the other hand, some of you have enjoyed the benefits of getting to know one another again. You’ve spent quality time together and that’s been great. You may have discovered how quickly your students can get their school work done without having to change classrooms, share a teacher with 20+ others, or wait for disruptions to be handled. There are more than a few families who have been paying quite a bit for private school and some of you are now realizing that if you invest that same amount of money in a creative academic plan (one that could easily include trips to places of interest as well as purchasing equipment to enhance learning) homeschooling might be a preferred choice!

Whether it was in anyone’s plans or not, every family in the United States that has school age children has now experienced a taste of homeschooling. However, to be fair, those of you who were forced into this situation were not able to experience what it is like to be a homeschooling family that has time to plan ahead, order the materials that best suits your students, organize field trips, or take part in the co-ops and enrichment programs that are offered to homeschooling students. Most of you experienced distance learning in a stressful environment. In many situations both mom and dad have been working from home and in between the Covid19 restrictions and sharing computers and WIFI (while arbitrating phone, t-v, and video game usage), the experience has been less than ideal. On the other hand, some of you have enjoyed the benefits of getting to know one another again. You’ve spent quality time together and that’s been great. You may have discovered how quickly your students can get their school work done without having to change classrooms, share a teacher with 20+ others, or wait for disruptions to be handled. There are more than a few families who have been paying quite a bit for private school and some of you are now realizing that if you invest that same amount of money in a creative academic plan (one that could easily include trips to places of interest as well as purchasing equipment to enhance learning) homeschooling might be a preferred choice! within 24 hours (coming from TN, FL, TX and CO). Although they did experience their share of sibling rivalry and silly arguments while growing up, they have been there for each other in time of need as well as in time of celebration.

within 24 hours (coming from TN, FL, TX and CO). Although they did experience their share of sibling rivalry and silly arguments while growing up, they have been there for each other in time of need as well as in time of celebration. homeschooled students in the unit because we were more likely to allow our students to take part in a search and rescue at any hour because we knew they could catch up on sleep or school work at another time. If you homeschool you will not be rushing out the door to get to the school (or to a bus stop) and you do not have to make sure your students are picked up (or brought home) each day, five days a week. No packing lunches (or providing lunch money). You want to take a vacation? Schedule it! If your parents are sick and in need of your help, you and your

homeschooled students in the unit because we were more likely to allow our students to take part in a search and rescue at any hour because we knew they could catch up on sleep or school work at another time. If you homeschool you will not be rushing out the door to get to the school (or to a bus stop) and you do not have to make sure your students are picked up (or brought home) each day, five days a week. No packing lunches (or providing lunch money). You want to take a vacation? Schedule it! If your parents are sick and in need of your help, you and your children can be there for them. Are there conferences and camps you would like to attend? Schedule it!

children can be there for them. Are there conferences and camps you would like to attend? Schedule it! colleges have experienced how well homeschooled students do on campus that they seek out homeschooled students. In fact, my position was created at Bryan College for this purpose! When parents are intentional about preparing their students to succeed after high school, and when students are equally invested, the results are often quite impressive.

colleges have experienced how well homeschooled students do on campus that they seek out homeschooled students. In fact, my position was created at Bryan College for this purpose! When parents are intentional about preparing their students to succeed after high school, and when students are equally invested, the results are often quite impressive.

Some students know from an early age exactly which college they plan to attend and they never waver! Others are not so sure they even want to attend college. Many students are open to looking at all options and would appreciate help narrowing down their choices. Choosing a college is not a decision lightly made and many agonize over this decision, yet armed with the right questions, the fields can be narrowed down to two or three top choices by a student’s junior year in high school.

Some students know from an early age exactly which college they plan to attend and they never waver! Others are not so sure they even want to attend college. Many students are open to looking at all options and would appreciate help narrowing down their choices. Choosing a college is not a decision lightly made and many agonize over this decision, yet armed with the right questions, the fields can be narrowed down to two or three top choices by a student’s junior year in high school. your visit.

your visit.

College visits: The best time to visit a campus is when classes are in session, but try to avoid exam week, if possible. You can visit when classes are out of session, but the visit will be better if that can be avoided. Being on campus while students are on campus and being able to sit in on classes are experiences that weigh heavily on the decision making process. In order to make the most of a college visit, call the department of admissions and find out if the college has a visit coordinator on campus. Ask when the visit days are available (you may be able to find this information on the college website). Ask to attend classes and talk with faculty. Tour the campus. Eat in the cafeteria. Observe current students and, if you have the opportunity, stop and talk to the students. Meet with the admissions office and financial aid. Ask about the application process and scholarship opportunities. Be prepared with questions to ask so you get all the information you need.

College visits: The best time to visit a campus is when classes are in session, but try to avoid exam week, if possible. You can visit when classes are out of session, but the visit will be better if that can be avoided. Being on campus while students are on campus and being able to sit in on classes are experiences that weigh heavily on the decision making process. In order to make the most of a college visit, call the department of admissions and find out if the college has a visit coordinator on campus. Ask when the visit days are available (you may be able to find this information on the college website). Ask to attend classes and talk with faculty. Tour the campus. Eat in the cafeteria. Observe current students and, if you have the opportunity, stop and talk to the students. Meet with the admissions office and financial aid. Ask about the application process and scholarship opportunities. Be prepared with questions to ask so you get all the information you need. Many homeschooled students take dual enrollment classes, earning both college credit and high school credit at the same time. This is a great option assuming your students can handle college level classes, keep up with assignments, and pass the class. However, in addition to student readiness, there are additional facts to consider before proceeding.

Many homeschooled students take dual enrollment classes, earning both college credit and high school credit at the same time. This is a great option assuming your students can handle college level classes, keep up with assignments, and pass the class. However, in addition to student readiness, there are additional facts to consider before proceeding. to lose. However, that is not the case. If a student fails to pass a class with a certain GPA there will be negative consequences. Many of the states that offer free, or reduced, dual enrollment classes often have stipulations that have to be met in order to continue receiving free (or reduced tuition) classes. These grants are lost if a student does not earn a high enough GPA in the class and, in some states, there is no way to regain the dual enrollment grant. If a student takes a class and does poorly, then losing the opportunity to continue taking college classes during high school for free (or at a discounted price) could be a costly mistake. Not only does the student lose the grant, but the parent could then become responsible to pay for the failed class out-of-pocket.

to lose. However, that is not the case. If a student fails to pass a class with a certain GPA there will be negative consequences. Many of the states that offer free, or reduced, dual enrollment classes often have stipulations that have to be met in order to continue receiving free (or reduced tuition) classes. These grants are lost if a student does not earn a high enough GPA in the class and, in some states, there is no way to regain the dual enrollment grant. If a student takes a class and does poorly, then losing the opportunity to continue taking college classes during high school for free (or at a discounted price) could be a costly mistake. Not only does the student lose the grant, but the parent could then become responsible to pay for the failed class out-of-pocket. Academic scholarships for freshmen are often determined by the students’ GPA and earned test scores (ACT, SAT and/or CLT). High school students who have a high GPA prior to taking DE classes could lower their GPA if they perform poorly in college classes. If a GPA is lowered to the degree that scholarships are reduced (or lost), then the “free” classes were not free after all.

Academic scholarships for freshmen are often determined by the students’ GPA and earned test scores (ACT, SAT and/or CLT). High school students who have a high GPA prior to taking DE classes could lower their GPA if they perform poorly in college classes. If a GPA is lowered to the degree that scholarships are reduced (or lost), then the “free” classes were not free after all. Because I homeschooled my students for 32+ years I have many friends who finished their homeschooling adventure long before I finally finished. One of the often heard regrets has to do with allowing high school students to attend college classes on a secular campus. The environment that students will be exposed to on a secular campus will be far different than the environment of a Christian campus. Yes, I am well aware that there are students on Christian campuses who do not live Christ-like lives but, hopefully, that will not be the norm. Not only should you be careful about the curriculum used on secular campuses (especially the literature assigned), but the worldview of the instructor could make a huge impact on your student, especially if he or she is an atheist with a pronounced agenda to debunk Christianity. Parents should not be sheltering their students 24/7, but they do need to be careful about putting students in certain situations before they are mature enough to handle those situations. Taking online courses may be preferable to on-campus classes, but if the courses are taught at a secular campus, then the material might conflict with your beliefs (depending on the class). Most homeschooling families have been so careful about making wise academic choices that it is surprising at how quickly many enroll their students in secular classes simply because of financial considerations. Please do not think that I am saying a parent should never allow students to take classes at a secular institution. Several of my children took both dual enrollment classes at secular campuses and two earned degrees from secular campuses. This is not a black-and-white, always do this or never do that conversation. You know your child better than anyone so prepare, plan, and pray that you will have the ability to steer your students on a course that is best for their future.

Because I homeschooled my students for 32+ years I have many friends who finished their homeschooling adventure long before I finally finished. One of the often heard regrets has to do with allowing high school students to attend college classes on a secular campus. The environment that students will be exposed to on a secular campus will be far different than the environment of a Christian campus. Yes, I am well aware that there are students on Christian campuses who do not live Christ-like lives but, hopefully, that will not be the norm. Not only should you be careful about the curriculum used on secular campuses (especially the literature assigned), but the worldview of the instructor could make a huge impact on your student, especially if he or she is an atheist with a pronounced agenda to debunk Christianity. Parents should not be sheltering their students 24/7, but they do need to be careful about putting students in certain situations before they are mature enough to handle those situations. Taking online courses may be preferable to on-campus classes, but if the courses are taught at a secular campus, then the material might conflict with your beliefs (depending on the class). Most homeschooling families have been so careful about making wise academic choices that it is surprising at how quickly many enroll their students in secular classes simply because of financial considerations. Please do not think that I am saying a parent should never allow students to take classes at a secular institution. Several of my children took both dual enrollment classes at secular campuses and two earned degrees from secular campuses. This is not a black-and-white, always do this or never do that conversation. You know your child better than anyone so prepare, plan, and pray that you will have the ability to steer your students on a course that is best for their future.